This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

A Market of Growing Choices and Steady Demand

Across all luxury tiers, one trend stands out: increased inventory. Whether you’re eyeing a $1M-$3M home or a $10M+ mansion, more properties are hitting the market, giving buyers unprecedented options. At the same time, sales remain steady to strong, signaling resilient demand despite this influx of listings. Pricing? Mostly stable, with slight adjustments in higher tiers—perfect for a balanced market where strategy pays off.

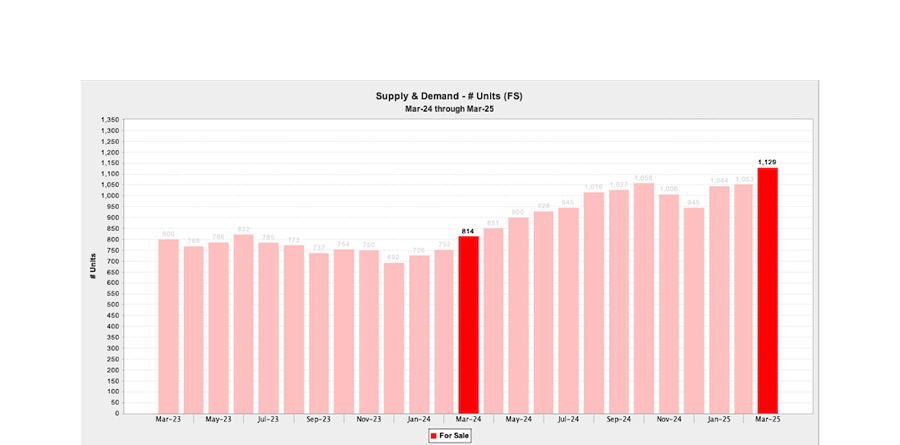

$1M-$3M market:

Inventory is up 39% year-over-year (1,129 homes), sales have surged 32% (155 closings), and the median price of $1.325M is up 3% from last year. Buyers have more choices, while sellers enjoy steady demand.

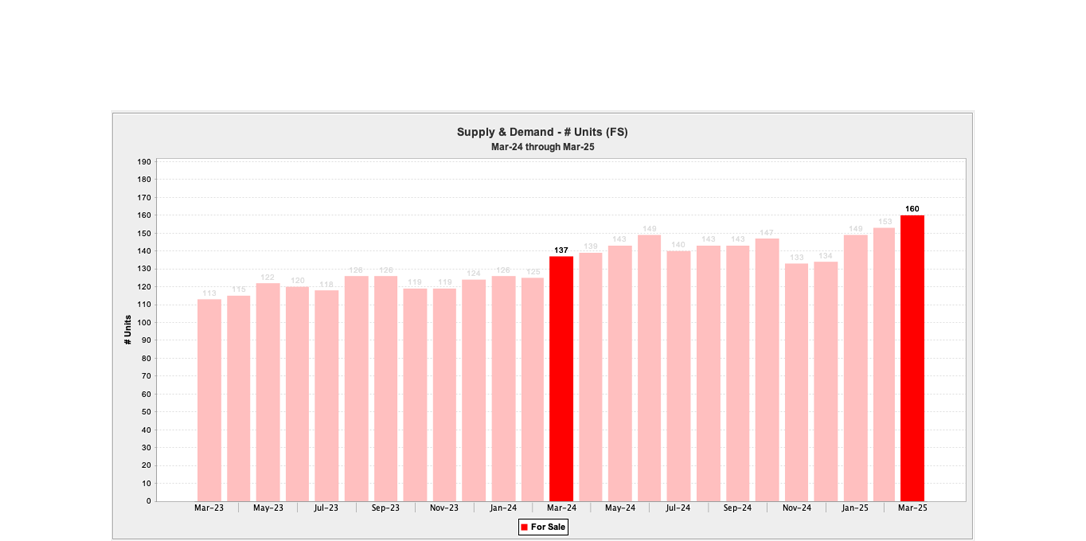

$3M-$5M market:

Listings rose 17% year-over-year (160 homes), sales climbed 20% (12 closings), and the median price hit $3.728M, up 7% from last month. A resilient segment with growing appeal.For sellers, this means well-priced homes are still selling, and with the right marketing strategy, properties can attract motivated buyers. While increased inventory requires sellers to be strategic, the overall market conditions remain robust.

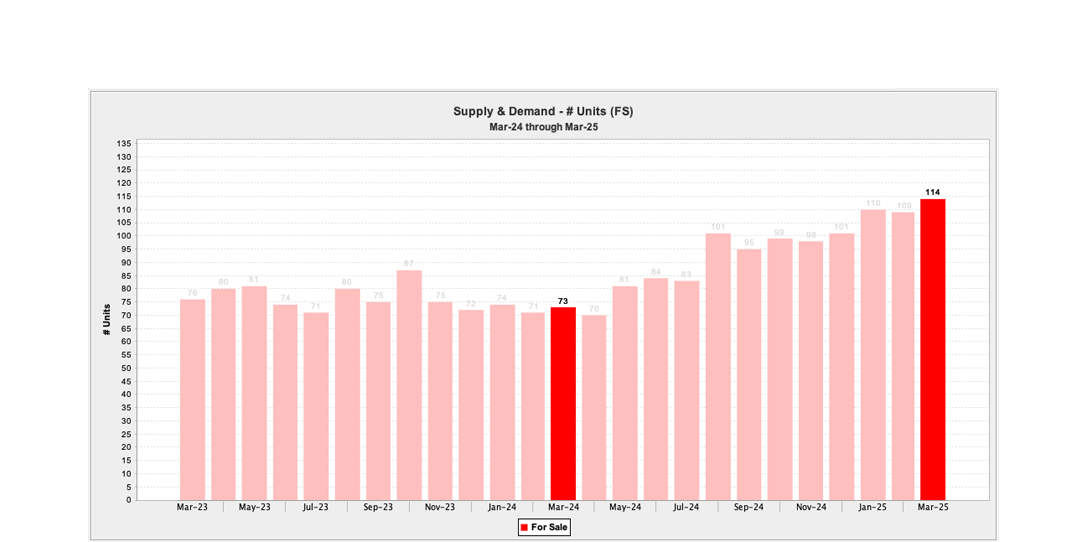

$5M-$10M market:

Inventory soared 56% year-over-year (114 homes), sales jumped 33% (8 closings), and the median price of $6.025M reflects slight adjustments (down 11% from last year). More options meet strong buyer confidence.

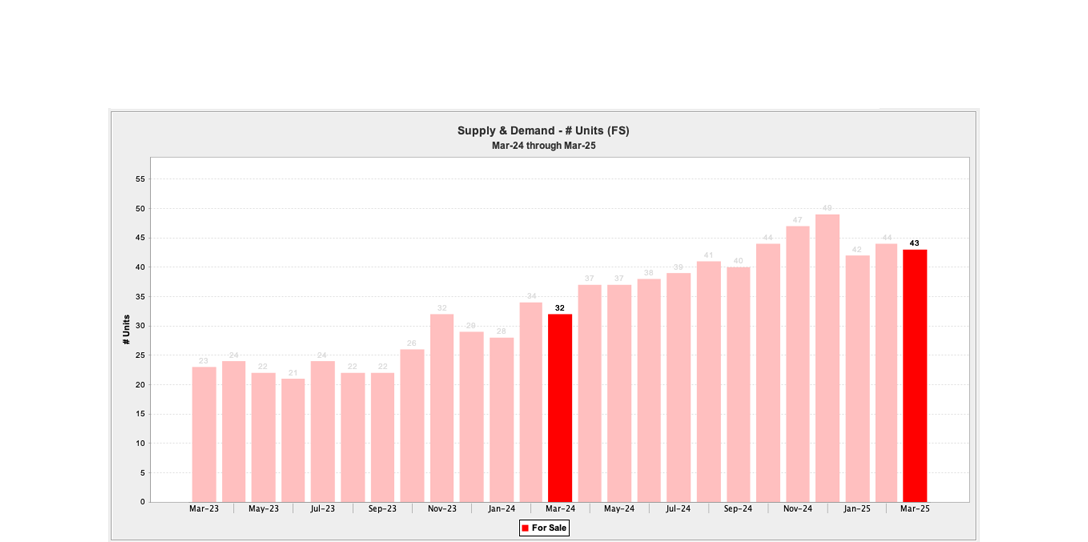

$10M+ market:

Inventory grew 34% year-over-year (43 homes), with sales holding steady at 3 closings. A selective market where positioning is everything.

Broader Economic Influences

The luxury market doesn’t exist in a vacuum. Here’s how bigger economic forces are playing a role: Stock Market Volatility: Recent ups and downs have some investors eyeing real estate as a safer bet. Luxury homes, with their tangible value, could see a boost from this shift. Inflation: Rising construction costs are making existing luxury properties more attractive than new builds, a win for sellers with move-in-ready homes. Interest Rates: With rates fluctuating, buyers might act fast to lock in financing, while sellers can appeal to those seeking long-term value in a shifting landscape. These factors add a layer of excitement—and urgency—to the Las Vegas luxury scene.

Why Las Vegas Shines

Beyond the numbers, Las Vegas offers a lifestyle few cities can rival. From dazzling shows to gourmet dining and exclusive leisure, it’s a magnet for those seeking more than just a home. This unique draw keeps the luxury market resilient, even as economic winds shift.

Opportunities for You

For Buyers: Now’s your moment. With more homes to choose from and less frenzy per listing, you can explore, negotiate, and secure your dream property—whether it’s a $1M retreat or a $10M estate. For Sellers: Demand is holding strong. Partner with a pro to price smartly and market boldly, and your home can stand out in this growing pool of options.

Final Takeaway

The Las Vegas luxury real estate market in March 2025 is a land of possibility. Buyers can revel in a wider selection, while sellers can capitalize on consistent demand. Whether you’re chasing a lavish lifestyle or a savvy investment, this market rewards those who act with strategy and vision. Ready to make your move? The Las Vegas luxury stage is set.This price resilience is a positive sign for sellers, showing that demand for high-end properties remains steady, and well-presented homes can command premium prices. For buyers, the recent uptick in pricing suggests that now may be the right time to secure a home before further increases occur.